Field 49 Confirmation instructions is a mandatory field in MT700 type SWIFT msg.

This field contains confirmation instructions for the LC receiver.

According to SWIFT

This field contains confirmation instructions for the requested confirmation party.

According to UCP600

Confirmation means a definite undertaking of the confirming bank, in addition to that of the issuing bank, to honour or negotiate a complying presentation.

So a confirming bank is required if the confirmation is added to the LC. Confirming bank takes the liability of the LC in case the issuing bank failed payment.

According to UCP600

Confirming bank means the bank that adds its confirmation to a credit upon the issuing bank’s authorization or request.

A confirmation charge is required for adding the confirmation. This charge may be on the applicant or the beneficiary side based upon their negotiation.

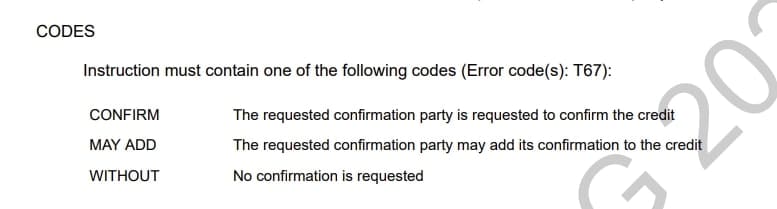

There might be three cases:

Confirm – This means this LC is needed to confirm by a confirming bank. If the issuing bank or confirming bank is not able to confirm the LC, it will inform the issuing bank.

May add – The receiver/beneficiary may or may not add confirmation in the LC if they want.

Without – No confirmation is needed in this LC

Why the LC add confirmation is required?

In general, the letter of credit is issued without add confirmation. In some cases, it’s risky for the beneficiary. The issuing bank may delay the payment because the Applicant failed to pay.

But if the confirmation is added then a Confirming bank takes liability for the payment.

So the beneficiary is secured.

If the Applicant/buyer is not known to the supplier or supplied doubt about the payment assurance, then they may ask for add confirmation.

It may be an alternative option for SBLC. In most cases, SBLC is not comfortable for the Applicant and is sometimes restricted by the central bank. The applicant’s money is blocked or collateral/lien is required to issue SBLC.

In that case, the Applicant may provide Confirmed LC and the Beneficiary can accept.

Sometimes in UPAS LC, confirmation is added which is a requirement of the discounting bank. The discounting bank may provide “confirmation” to the LC or there might be another confirming bank.