This is an optional field in the MT700 type SWIFT message of a documentary Letter of Credit (L/C).

These are the conditions that are added by the buyer/applicant or the issuing bank providing further instructions to comply.

Additional conditions include the information that should be mentioned in commercial documents (commercial invoice, packing list), email or fax instruction, signature requirement, discrepancy handling charge, etc.)

The beneficiary must make a presentation by confirming these additional conditions.

Let’s bring one example UPAS L/C for our analysis

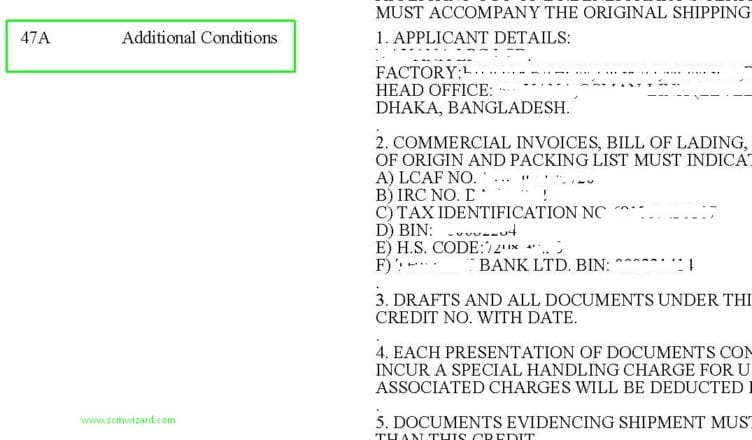

Field 47A (Additional Conditions)

1 APPLICANT DETAILS

Here the detailed applicant address is written. In the case of including applicant detail in documents, these addresses should be followed. In F50 (Applicant) only the Applicant name is written but due to space limitation detailed address cannot be mentioned, so here the detail address is written.

2 COMMERCIAL INVOICES, BILL OF LADING, CERTIFICATE OF ORIGIN, AND PACKING LIST MUST INDICATE THE FOLLOWING

A) LCAF NO

B) IRC NO

C) TAX IDENTIFICATION NO

D) BIN

E) H.S. CODE

F) ISSUING BANK BIN

These are the norms that should be included in CI, BL, COO, and PL.

IRC is the Import Registration Certificate

BIN is the Business Identification no.

3 DRAFTS AND ALL DOCUMENTS UNDER THIS CREDIT MUST QUOTE THIS CREDIT NO. WITH DATE

Letter of Credit (L/C) number and opening/issuing date should be mentioned in the draft (Bill of Exchange) and other documents.

4 EACH PRESENTATION OF DOCUMENTS CONTAINING DISCREPANCY WILL INCUR A SPECIAL HANDLING CHARGE FOR USD 75.00 AND ANY OTHER ASSOCIATED CHARGES WILL BE DEDUCTED FROM THE PROCEEDS.

The discrepancy charge which shall be deducted in applicable cases is mentioned. Sometimes related cable charge is also mentioned for transparency.

5 DOCUMENTS EVIDENCING SHIPMENT MUST NOT BE ISSUED EARLIER THAN THIS CREDIT

The seller cannot make shipment and prepare documents before the L/C opening. This is a standard practice in commercial L/C. So, the exporter can make shipment only after the LC is opened.

6 ALL DOCUMENTS MUST BE PRESENTED IN ENGLISH LANGUAGE

This says that the documents must contain the English language, no local language is applicable. This is an international business between cross borders so English is the common language to be followed by both the applicant and the beneficiary.

7 INVOICE MUST CLEARLY SHOW THE PRICE OF THE GOODS AND FREIGHT CHARGE SEPARATELY OR A SEPARATE FREIGHT CERTIFICATE FROM BENEFICIARY MUST ACCOMPANY THE DOCUMENTS

This is the rule of Bangladesh central bank (Bangladesh Bank) that the goods price and freight charge should be mentioned separately in commercial invoice.

According to that information, they prepare the import data. Two common forms are being used by the bank IMP Form and T/M Form and filled up by the applicant to report to Bangladesh bank.

8 THE APPLICANT BANK BIN AND APPLICANT’S VAT NO MUST BE MENTIONED IN ALL DOCUMENTS

This indicates that the applicant’s bank’s VAT and BIN number should be mentioned in all documents.

9 PLUS/MINUS 10 PERCENT TOLERANCE IN BOTH AMOUNT AND QUALITY PER SIZE ARE ACCEPTABLE, BUT TOTAL AMOUNT AND QUANTITY SHOULD BE WITHIN THE LC TOLERANCE

For some material (here Steel) the tolerance is applicable. Ten percent tolerance for quantity and the total invoice value will be agreed upon by the applicant. While submitting a commercial invoice the value cannot exceed 10% more than the L/C value.

There’s another optional field is in LC which F39A (Percentage Credit Amount Tolerance). If you specific tolerance in F39A then, clause F47(9) is not required.

10 DESPITE THE TENOR OF THIS CREDIT (180 DAYS FROM THE DATE OF NEGOTIATION) THE APPLICANT BANK, OFFSHORE BANKING UNIT, WILL REMIT PROCEEDS AT SIGHT UPON PRESENTATION OF CREDIT COMPLIED DOCUMENTS

Actually, this example is based on UPAS L/C (Usance Payable At Sight). As per UPAS LC rules, the beneficiary will get payment on sight basis though the applicant will pay after 180 days to the applicant bank hence the Financing bank (OBU of the applicant bank).

Hallo,

need your help to adv detail instruction on field 78 for UPAS LC,

or may I get general MT700 for UPAS LC field.

Thank You

Hi Dean,

Thanks for your comment. In F78 (Instructions to the Paying/Accepting/Negotiating Bank) the LC opening bank write instruction about the documents to be submitted for payment. In UPAS LC instruction is mentioned for the discounting bank where the documents have to be submitted for payment. here’s an example of F78 in UPAS LC:

1)ALL DOCUMENTS MUST BE SENT TO (DISCOUNTING BANK SWIFT) BANK LIMITED, BRANCH, COUNTRY.

2)UPON RECEIPT OF FULL SET OF DOCUMENTS IN STRICT COMPLIANCE

WITH THE TERMS AND CONDITIONS OF THE CREDIT, WE WILL ADVISE

ACCEPTANCE TO (DISCOUNTING BANK NAME), (SWIFT) AND

THE BENEFICIARY’S BANK WILL BE PAID IN DOCUMENTARY CREDIT’S

ISSUING CURRENCY AT 30 DAYS FROM B/L BY (DISCOUNTING BANK), (SWIFT).

Feel free to contact me directly through the contact page for further clarification.

Shipment is FOB, in L/C showing as below;

047A clause

L/C value represent CFR Value of Goods

what does it means ?

Hi Rajendra,

Thanks for your question. If the shipment is FOB then LC value should be FOB. Can you share exactly what clause is there in 47A and which incoterm is mentioned in 45A?

Can you please clarify the latest by the next day of negotiation in lc clausea

Hi Anamika, Which LC Field you are referring to?

need your help on LC , F47A. What does it mean ‘

6.Documents must accompany beneficiary’s certificate to the effect that goods shipped are strictly as per above proforma invoice and all the terms and conditions of the LC thereof has been.

7. country of origin, importer’s name, tin and bin must be either be printed or written in unremovable ink at least 2pct on the package/cover/wooden box/ other packages on the biggest package/ box of the shipment and this should be certified in packing list.

Hi Resh,

6. This is a document issued by the beneficiary just stating that goods are shipped as per PI and maintain LC terms and conditions. It’s a very simple document. Communicate to my email, I’ll send you the sample copy.

7. This is the policy as per IPO 2015-18 (Chapter 2 Clause 7). There are some exceptions (i.e in bulk goods you don’t need to do this).

Let me know if you have further questions.

So far i know, all documents to be asked for under 46A. However if any regulatory doc i.e. payment to be released once custom house provides positive report about the goods (clause inserted due to covid) is asked for under 47A and if it is not given, what woukd be the action of issuing bank?

Thanks for your question. If the clause is inserted in F47A (payment to be released after report), then the bank can hold the payment and wait for the report.

Hi Mukit,

need your help on LC , F47A _clause no 7. What does it mean ?

we are exporting in a bulk good and we received a discrepancies from bank on this. Can you give me a sample of the document ?

Can anyone help me with this countersignature clause in Documentary credit to avoid discrepancy on my documents. Your answers will be helpful for clarification. Thanks in advance.

In letter of credit, if field 50 is under company A and there’s a special instruction to indicate Company B on all the required documents. However, countersignature on delivery note is required. Which company stamp the applicant shall use?

And what if the applicant uses the company stamp of company B, is there any potential discrepancy on the documents?