You must be familiar with this field as because it’s mandatory in Letter of Credit MT700 Swift message.

Available With…

It indicates the bank for the presentation of documents. So the beneficiary identifies where the credit will be available upon presentation.

There are two formats:

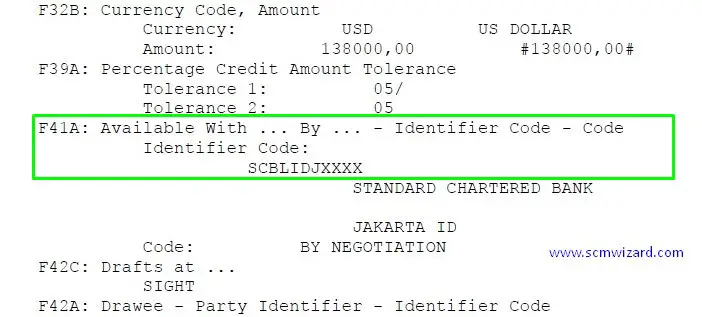

41A – This is mentioned where the nominated bank is identified by BIC (Bank Identified Code) AKA Swift code.

In the above example, the nominated bank SWIFT code is mentioned. That means the beneficiary has to submit the documents in that bank to get the payment.

41Afield is being used as the bank SWIFT code is mentioned there.

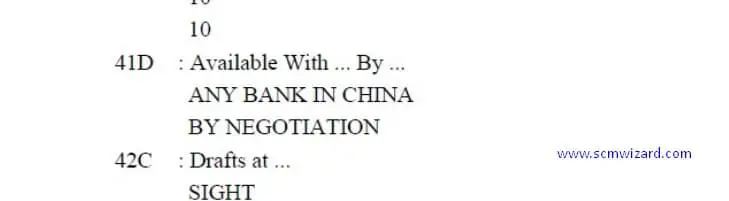

41D – This is mentioned where the nominated bank is identified by name and address.

If the bank is fixed then the bank name and detail address is mentioned. In the case of ‘non-restricted’ type “Any Bank in …” can be mentioned. That means the beneficiary can submit a document to any bank of their country.

If the country is not mentioned then the document can be presented to any bank (borderless).

Here the bank is used “Any Bank in China”. So 41D field is being used.

This is an example of a Letter of Credit at sight.

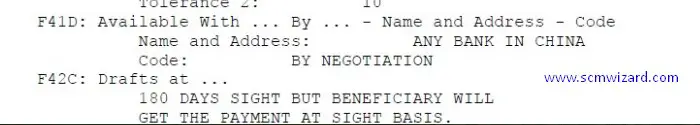

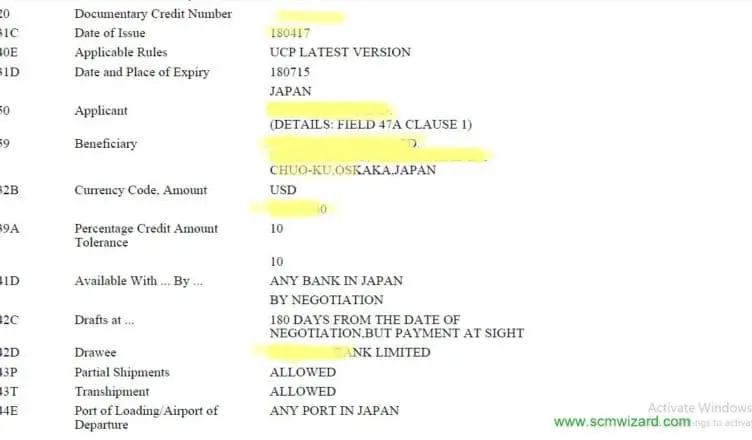

Another example of Letter of Credit UPAS type. Check below:

In most of the cases advising bank is the negotiating bank/presenting bank if the beneficiary does not use another bank than the advising bank.

By…

This field indicates how the credit is available. It can be either by acceptance, by payment or others.

So, here several options are available.

BY NEGOTIATION

BY PAYMENT

BY ACCEPTANCE

BY MIXED PYMT

BY DEF PAYMENT

In the above example, I’ve shown “BY NEGOTIATION”. In case of “at sight L/C” or “UPAS L/C” you can use “BY NEGOTIATION”.

BY PAYMENT also you can use for at sight payment.

I’ve shown some examples from several Import LC’s at Bangladesh where the LC is made available “BY NEGOTIATION” in both cases of “sight LC” and “UPAS (Usance Payable at sight) LC”.

Don’t hesitate to share your thoughts. If you have any confusion of this field, let me know by comment below.

Which will be benefited for beneficiary of sight payment in F41A ” 01. Applicant’ bank by payment or 02. Any bank in Beneficiary county by negotiation.”

Hi Safiul,

Nice question. There are differences between LC available with “by payment” and “by negotiation”.

If you received LC available by payment, then normally you will get payment by negotiating documents but you can’t get advance payment by selling documents at a discount at your bank. The complying documents have to be presented at issuing bank or nominated bank counter to get payment.

In case you have received LC available by negotiation, then you may get payment in advance by negotiating the draft or documents at the nominated bank which is normally at your country. You can also discount the draft, So you have both options.

I hope you are now clear which method is benefitted for you. Available “by negotiation” is the most suitable for you because you can get payment by negotiation or by discounting.

also, if you put “any bank” then you can present documents any bank suitable for you.

Hello dear,

Who can help me to make LC documents very correctly? Thanks in advance!

Whatsapp:+8618906722120

hi Jobair,

if you need any help for LC documents you can contact us through here

https://scmwizard.com/contact/

If L/C is not L/C at sight ( I mean deferred L/C ), which words is suitable : BY NEGOTIATION OR BY PAYMENT?

Thanks for supporting me.

Warm regards,

Hi,

Thanks for your question. You may read my reply to another comment where I”ve described the difference between “by negotiation” and “by payment”. Even for the Deferred L/C the preferred option is “by negotiation”.

Hi Mukit,

Can elaborate full form of

FI BIC

in LC term 42A Drawee

Hi Mushir,

Thanks for the question. In F42A the Drawee identification is mentioned who will draw the ‘drafts’. Applicant’s bank is the drawee of the drafts and identified by FI/ BIC, which means Financial Institute / Bank Identification Code. Bank’s SWIFT code is mentioned in this field to identify the drawee.

Hope it’s understandable now.

i have received LC with clause 41D available with by “advising bank by negotiation”

however, LC advised by SCB bank and we want to routine the shipping document through another bank. is it correct or LC opening bank marked discrepancy?

please advise.

Hi Rehan,

Thanks for your question. If 41D states “Advising bank by negotiation”, then you have to negotiate docs through advising bank (here SCB). You cannot send docs through another bank. Either that bank will not accept the docs or opening bank will provide discrepancy.

So the right option is to mention in 41D “Any bank by Negotiation”, then you can receive LC from SCB(or advising bank) and then negotiate in any bank in your country.

Hi Mukit,

Field 41D in my LC says ‘Any Bank in India, By Negotiation’

but I want to restrict the payment made by drawee bank to advising bank only without any involvement of intermediary bank.

Please advise how to proceed.

Thank you for your support. Could you please inform concerning the difference in F41A between by def payment and by acceptance

Best regards

If we issue a usance LC can 41 D Availabe with any bank by payment is applicable

if no what is the reason?

Hi Kadam,

You can issue usance LC where F41D Available with any bank by payment is possible.

Hi Sir, What is the difference between

41A /available with…by SA Bank by negotiation

and

41D/available with…by any Bank by payment.

Hi Sam, I”ve already replied to the same question in Safiul’s comment. pls check the comment section and you will find it. if you have further questions, you can ask here.

Hi I am from Bangladesh I have received one LC here mention like that

F41D : Available with …. By… Name and Address- Code

LC issuing Bank Name

Code : By Payment

My asked me need to amendment ” Available in any bank in Bangaldesh”

Code : By Negotiation

Please advise what can I do for this LC.

Hi Ekhteir,

Thanks for your question. The LC you have received from the buyer is workable. In this case, your bank should send the documents to LC issuing bank for negotiation and payment. as by payment is mentioned, you will receive payment only by documents negotiating at the issuing bank mentioned in 41D. You cannot take advance or discount the invoice.

This is similar practice for import LC where discounting bank name is mentioned in 41D i/o of advising bank which may be a foreign bank. You can refer your bank to that type of LC and manage without amendment.

Dear Mukit,

I have received a LC which customers mention as below

F41D : Available with …. By… Name and Address- Code

LC issuing Country Bank Name

Code : By Payment

Our local bank nobody have accept this clause. Please advise how can I solve the problem.

Hi, received a new LC with 41A show available with.. BY BANK”A” by payment.

But there is no 42 C or 42 D on LC. what it means.

Can I submit original documents to BANK A without draft.

Hi Sam,

Thanks for your question. If 42C or 42A is not present in the LC, then 42M or 42P might be there. thought any of these is not a mandatory field. please check and inform me.

Hi,

there is no 42M or 42P

It’s okay. You can submit without Draft if it’s not mentioned in 46A(required documents) and the LC is at sight and by negotiation.

otherwise, you can submit with Draft even 42C or 42A field is not present.

Hai, i have received a LC stating that 41D: Any bank By Mixed Payment.

Should i have to add BY Negotiation also in this clause. Please clarify.

There is another field 42M for Mixed Payment. In the case of mixed payment, you can mention By Negotiation or By Acceptance or others depends upon your mixed payment method agreed with the buyer.

There is another field 42M for Mixed Payment. In the case of mixed payment, you can mention By Negotiation or By Acceptance or others depending upon your mixed payment method agreed with the buyer.

I have LC Received with

41D : available with …. By…. – Name&Addr

ANY BANK

BY PAYMENT

But clause “42C : Draft At Sight” is missing

Please advise what to do ? Can I present documents with DRAFT AT SIGHT ?

with this LC

as the F42C is not present, you don’t have to present DRAFT AT SIGHT. in 41D BY PAYMENT is mentioned, so DRAFT is not required.

but if 46A (DOCUMENTS REQUIRED) mentions Draft, only then you can present to avoid discrepancy.

We have received LC as below and transferred same LC to factory.

Available With … By …

ANY BANK IN BANGLADESH

BY NEGOTIATION

now factory is asking “Please add Payment terms in your L/C its mandatory”. Please advise what to do.

Hi Prodip, payment terms should mentioned in 42C

Hi!! Field 41A is restricted to any other bank in beneficiary’s country. Is it compulsory to present documents to restricted bank?? LC is not CONFIRMED LC.

Can’t we send documents directly to LC Issuing Bank thru our bankers??

Hi Ajay, If the bank name is mentioned in 41A, then you have to send documents to LC issuing bank through that bank

Kindly explain clause 41A & 41D in details.

Hello Mukit

The Bank A of Spain has issued LC mentioning his name & address in 41A by def payment and also in field 78 (instructions to payg/acceptg/negt bank) mentioned “documents must be sent to us through them ” having address of Bank A of Hong Kong. So to whom we have to dispatch documents.

Hi Kamlesh,

Thanks for your comment. If Bank A mention their Hong Kong address and “documents must be sent to us through them” then beneficiary bank should dispatch documents to Bank A Hong kong.

Lc was issued with 41d : any bank in Singapore, by negotiation

But we received documents through China

Can we quote discrepancy??

Hi Pratima,

As per 41D, documents should be negotiated with any bank in Singapore. but the documents are sent from China, it should be dicrepancy.

Lc issuing bank in china , 42 c : at sight, 42d: any bank in china by negotiation.

Is it possible? No I involve beneficiary bank? With conditions TT reimbursement allow. Pls help advise

Hi,

Our supplier is asking that “You have to bring the following modifications to understand if there’s any possibility to have the L/C confirmed from COMMERZBANK:

– Report COMMERZBANK at field 41 (available with)

– Cancel the fields 42C and 42A”

Is It possible to delete 42C & 42Z