Previously I’ve discussed important fields present in a Letter of Credit (i.e F46A Required Documents, F47A Additional Documents, etc.).

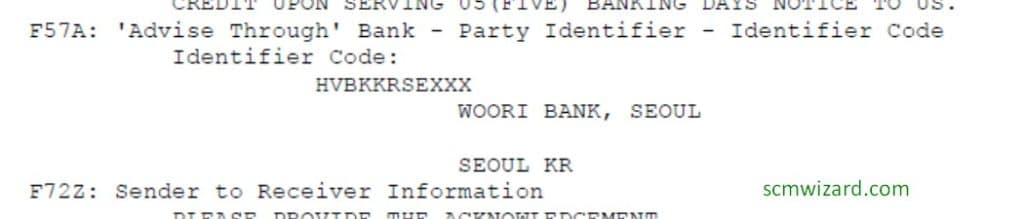

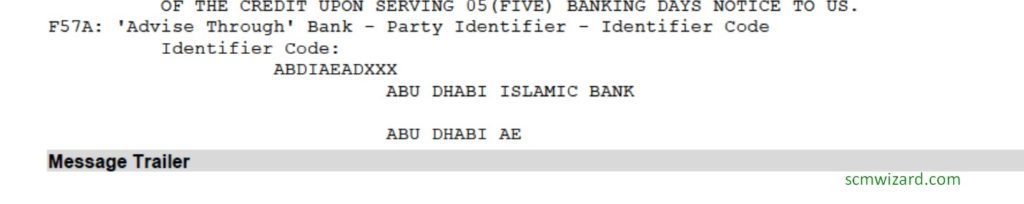

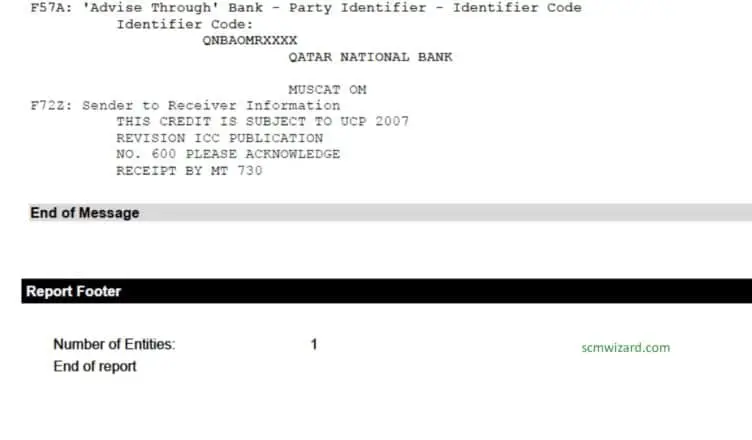

Here we will discuss Field F57A where ‘Advise Through’ Bank – Party Identifier – Identifier Code is described.

What is ‘Advise Through’ Bank?

This is an optional field in MT700 swift message.

Here, this field identifies the bank if it’s different from the LC receiver where the LC has to be advised/confirmed to the beneficiary.

Let me give you an example to understand easily.

Scenario 1:

Suppose the LC issuing bank is ‘Bank A‘.

The Advising bank is ‘Bank B‘.

Note that LC issuing bank located in the Applicant country and LC advising bank located in Beneficiary country.

Negotiating bank maybe the same as the Advising bank.

Now ‘Bank A’ don’t have RMA with ‘Bank B‘

So they will take the help of ‘Bank C‘.

‘Bank A‘ will send LC to ‘Bank C’.

[sender ‘Bank A’] [receiver ‘Bank C’]

‘Bank C‘ will advise LC to ‘Bank B‘

In this LC ‘Bank B‘ identifier will be mentioned in F57A.

[F57A ‘Bank B’]

So, as per definition, LC is to be advised ‘Bank B’ to the beneficiary.

Scenario 2:

Suppose the LC issuing bank is ‘Bank A‘.

The Advising bank is ‘Bank B‘.

Now ‘Bank A’ have RMA with ‘Bank B‘

So, what will be mentioned in F57A?

Actually, in this LC, F57A will not be required.

Important notes:

# Advising bank and Negotiating bank may be the same. In that case, both F41A and F57A bank name will be the same.

# Sometime LC discounting bank may be mentioned here.

# ‘Bank C’ is the Intermediary bank.

FAQ

What is advising Bank and negotiating bank?

Advising bank notifies and advises Letter of Credit to the beneficiary (exporter). The beneficiary negotiates the documents to receive the payment through Negotiating bank.

Can advising bank act as negotiating bank?

If the beneficiary wants, he can negotiate the documents through the same bank that Advise the LC. In that case, Advising bank act as Negotiating bank.

If you have any questions, feel free to comment or send me an email.

If an LC doesn’t mention field 57A how can be advised to the final beneficiary

F57A is not a mandatory field. If the beneficiary bank differs from the LC receiving bank, this field mentions the beneficiary bank. If the the LC receiving bank can advise LC to the beneficiary directly, then no need to add this field.