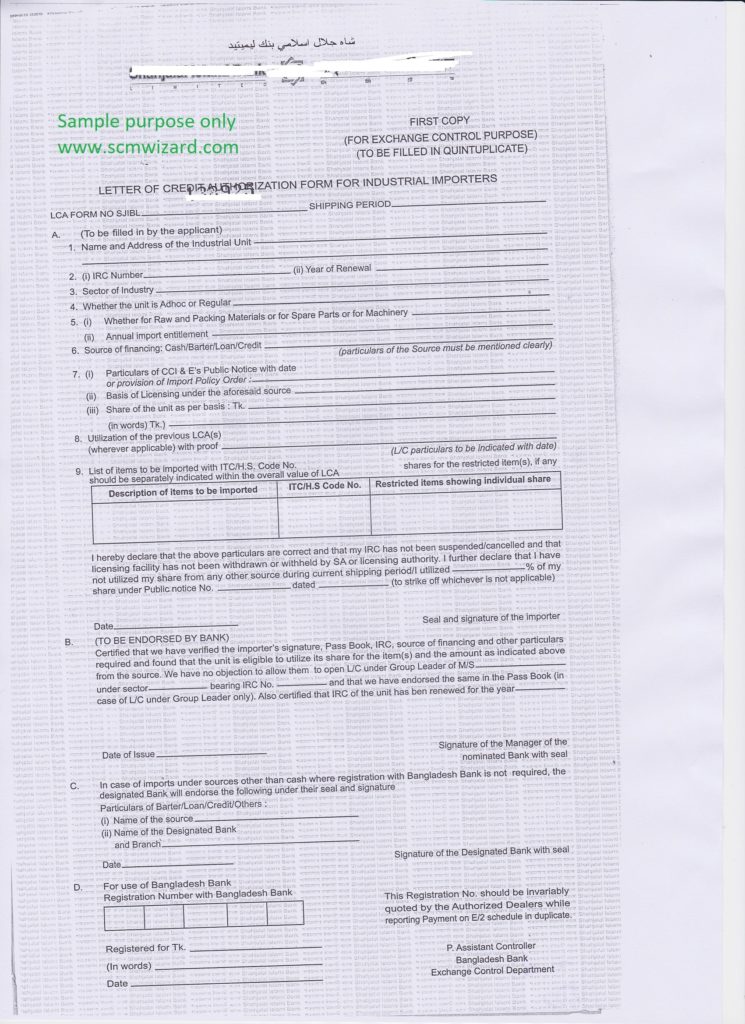

LCAF form is a Letter of Credit Authorization Form.

It is used to allow opening LC (Letter of Credit) to import from abroad. Though LCAF is required for the opening of LC, this is required, in some cases, for import without LC as per IPO, Bangladesh.

Types

There are 2 types based on the IRC (Import Registration Certificate) type.

- For Commercial Importers

- For Industrial Importers

LCAF copies

There are 6 copies:

- Original: For Exchange Monitoring purpose (to be filled in Quintuplicate)

- Duplicate: For customer purpose (to be filled in Quintuplicate)

- Triplicate: For the Licensing Authority (to be filled in Quintuplicate)

- Quadruplicate: For the Licensing Authority (to be filled in Quintuplicate)

- Quintuplicate: For the registration Unit of Bangladesh Bank (to be filled in Quintuplicate)

- Office copy

Procedure

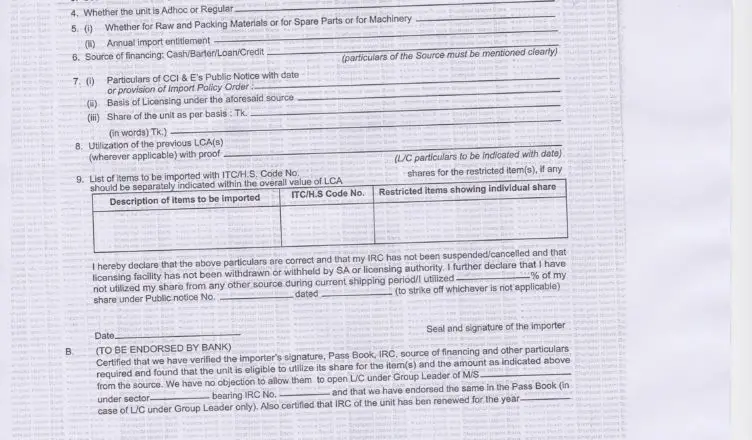

The applicant (importer) fills up the LCAF form and submits it to the LC opening bank with a sign and seal along with other necessary documents.

The bank verifies it and submits the information to a central software system. Previously the bank sends copies to the relevant department but now the information goes online and the hard copies are kept by the bank for future audit and record-keeping purposes.

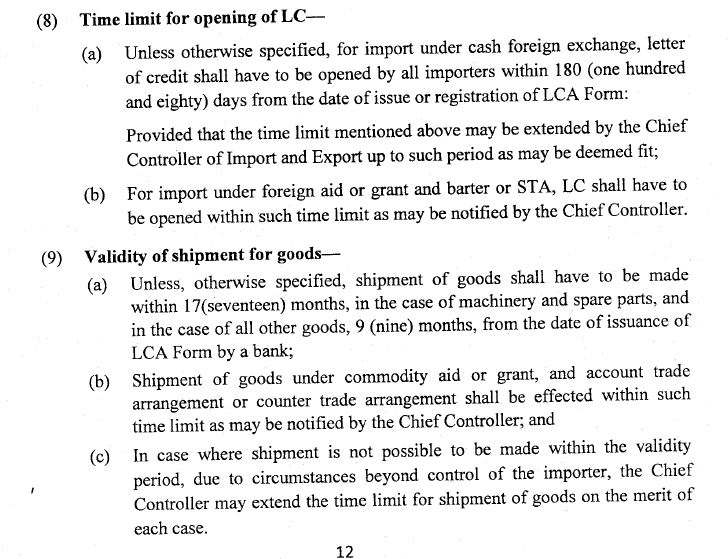

Source: IPO 2015-2018

Letter of Credit Authorization Form (LCAF) has three types of validity

i) Validity for opening LC- within 180 days of issuance (Para 8(8) of Import Policy Order, 2015-18).

ii) Validity for shipment- 17 months for capital machinery and 9 months for other items from the date of issuance (Para 8(9) of Import Policy Order, 2015-18).

iii) Validity for payment- 18 months subsequent to the month of issuance for capital machinery and 12 months for other items (Para 3(c), Chapter 7, Guidelines for Foreign Exchange Transactions Vol-1).

Important Note

LCAF is used if you import material without a letter of credit. For CAD (Cash Against Documents) process LCAF is also required in Bangladesh.

In the letter of credit, the LCAF number is mentioned and instructed in F47A (Additional Conditions) to mention the LCAF number in shipping documents.

Source: IPO 2015-2018

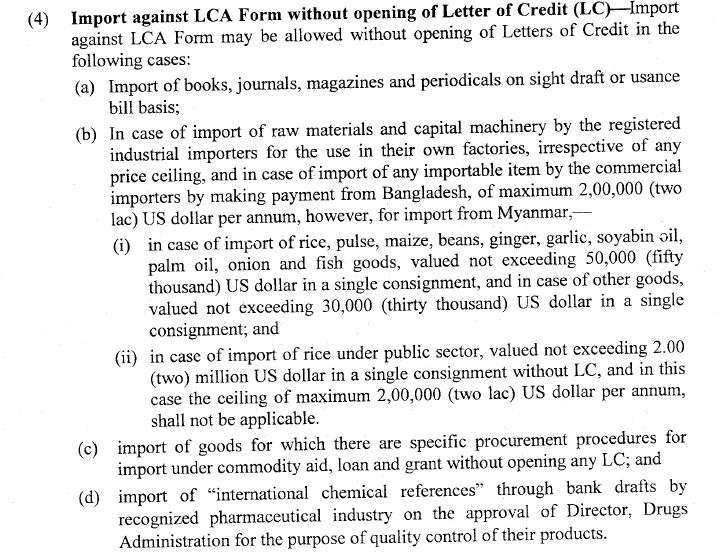

Import against LCA form without opening LC may be allowed in the following cases

- Import of books, journals, magazines, and periodicals on a sight draft or usance bill basis.

- In case of import of raw materials and capital machinery by the registered industrial importers for the use in their own factories, irrespective of any price ceiling, and in case of import of any importable item by the commercial importers by making from Bangladesh, of maximum 200,000 (two lac) US dollar per annum….

- Import of goods for which there are specific procurement procedures for import under commodity aid, load, and grant without opening LC

Note: Import without LC is restricted for up to $200,000 per year and to some restricted items like books, journals, etc.

Source: IPO 2015-2018

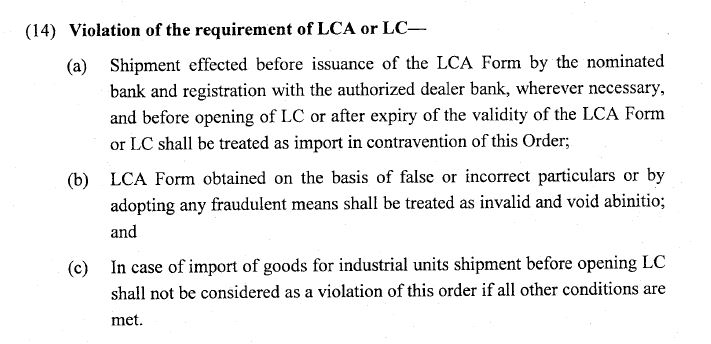

Violation of requirement of LCA or LC (As per IPO)

LCAF sample

For your understanding, I’m attaching the first copy of Industrial LCAF just for reference.